What are some features of personal finance apps?

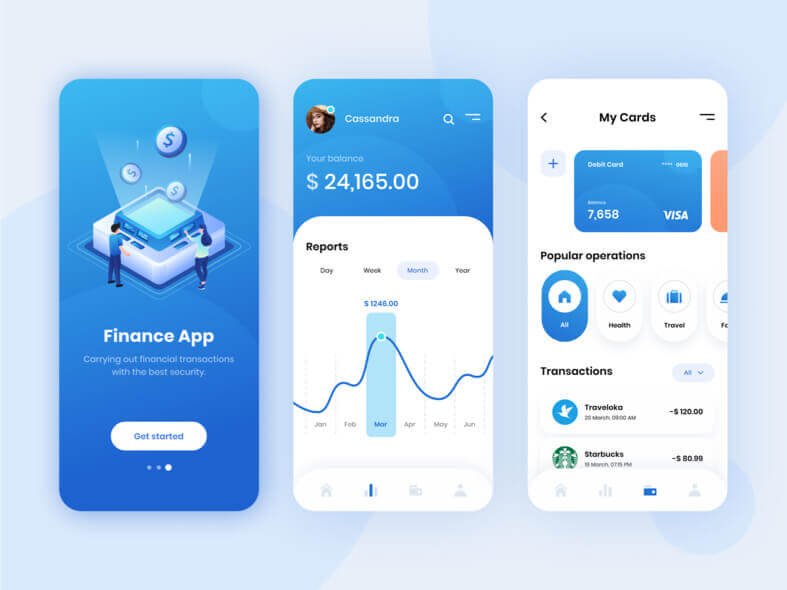

If you're buying a personal finance app for your smartphone, you've arrived at the right place. With a selection of features that help you manage your finances, this app could be a lifesaver. It can help you to stay together with your finances and set financial goals, while monitoring your daily expenses. Personal finance apps can assist you to create a monthly budget and build financial stability. But what should you appear for in your own finance app?

Some apps offer basic functionality and are inexpensive to develop. Others offer more advanced features, including the capacity to link bank cards and bank accounts, along with perform some tasks that help you keep track of your finances. Several apps can even be gamified for extra fun. The option is yours, but make sure to check the reviews and ratings before building a purchase. When it doesn't meet your standards, you're probably better off with a simpler app.

Most personal finance apps lack functionality for joint bank accounts, which makes it difficult to help keep track of all finances of family members. Adding this feature is essential. Another important feature is real-time synchronization with bank accounts. If you've got a joint bank-account, consider causeing the feature for sale in your personal finance app. If you're aiming for a advanced of user experience, make sure that your app comes with an easy-to-use interface and features.

Money management apps like haushaltsbuch appis the modern trend in smartphone technology. They are able to allow you to track your spending, create budgets, and policy for the future. A great personal finance app won't only stop you organized and informed about your spending, but will also offer you advice on how best to improve your money management skills. Listed below are some examples of money management apps you can use to manage your finances. If you're a beginner, try one for free.

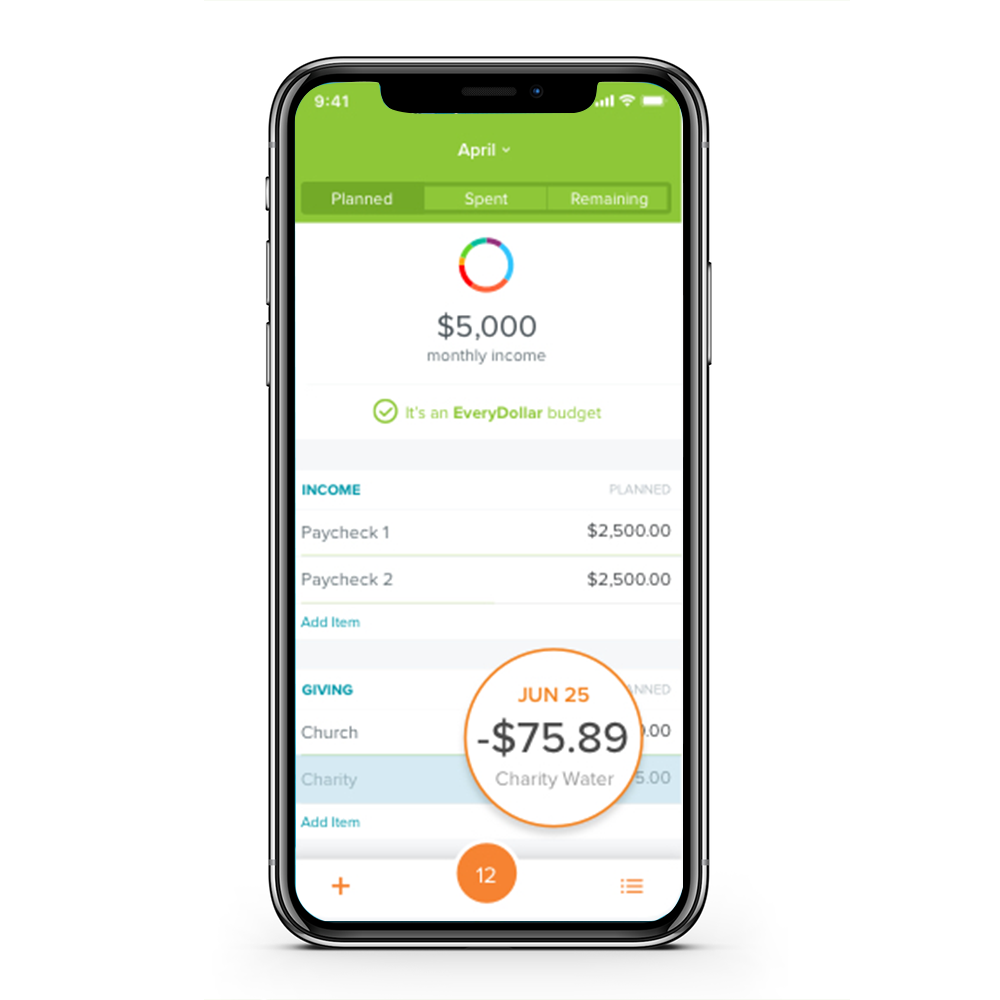

The main dashboard of a personal finance app could be the core of the app. It's a main hub for the custom information regarding your finances, including budget categories and transactions. A sidebar will soon be visible on the key dashboard and will permit you to access the app's other features. A well-designed and easily accessible dashboard will ensure a seamless experience for users and make account management easier. Besides, it will also allow it to be better to track your spending.

An app with a money sector focus can cost anywhere from $7 to $15 per month. Even a low-end app like Acorns can assist you to build lifelong wealth. It may even allow you to invest a $1,000 for your child's future. The most effective personal finance app uses modern encryption technologies to secure your individual information. It will even allow you to create investment accounts for minor children or invest spare change. So, if you're intent on developing a personal finance app, don't let costs deter you.

An chatbot is another feature that may enhance the overall app experience. It may even redirect users to an economic consultant when needed. Numerous personal finance apps also enable users to create categories and set personal goals.

For more information you should click on this link household book (Haushaltsbuch)